Retirement calls for a steady stream of incoming cash, so you can enjoy the retirement life you've always dreamed of. Let's face it, relying solely on piggy bank funds won't cut it when it comes to covering those retirement expenses.

Now, you've likely heard about reverse mortgages in your search for solutions, but what about annuities? Keep reading this article to learn how each of these financial options can benefit you.

-

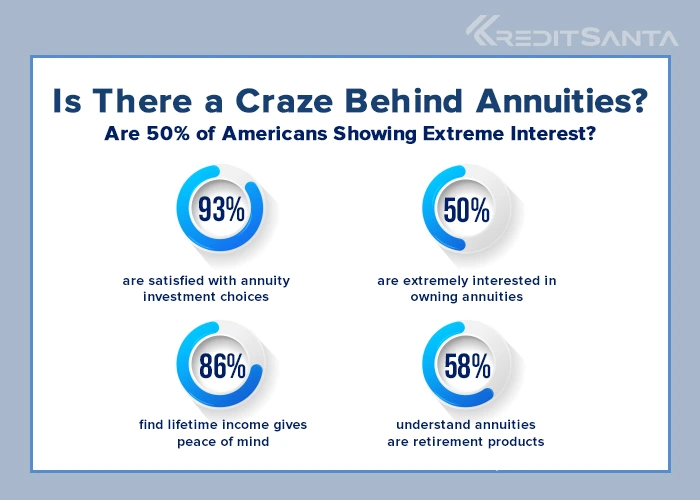

The desire for security in retirement is rising, with 97% valuing guaranteed lifetime income alongside Social Security.

-

Annuities are often purchased to add to existing retirement funds like pensions and Social Security benefits.

-

Reverse mortgages may have high upfront costs compared to other ways of borrowing against home equity.

-

Annuities come in immediate or deferred options, allowing for income either now or in the future, depending on individual needs.

Things to Remember

Annuities and Reverse Mortgages Explained

First up, let’s talk a bit about annuities!

Annuities are financial products offered by insurance companies. They're essentially a contract between you and the insurer.

They’re often used as a way to supplement retirement income, providing a steady stream of payments to cover living expenses, healthcare costs, and other needs.

Here's how they work -

-

You pay the insurance company a certain amount of money upfront, either in a lump sum or through installments.

-

In return, the insurer promises to pay you back regularly over a specified period, which could be for a set number of years or for the rest of your life.

Now, let’s move on to reverse mortgages!

Reverse mortgages are specifically designed for homeowners who are typically older, usually aged 62 or older.

These mortgages allow homeowners to convert a portion of their home equity into cash without having to sell their home or make monthly mortgage payments.

A reverse mortgage can be of great value to retirees who need extra income to cover expenses, pay for healthcare, or fund other financial needs.

Here's how they work -

-

Instead of you paying the lender each month, the lender pays you, either in a lump sum, through monthly payments, or as a line of credit.

-

You continue to own your home and are responsible for property taxes, insurance, and maintenance.

-

The loan must be repaid when you move out of the home permanently, sell the home, or upon your passing.

-

If the loan amount exceeds the value of the home when it's time to repay, the lender cannot seek additional payment from you or your heirs. This feature is known as non-recourse protection.

Assess Your Eligibility & Calculate Reverse Mortgage Funds

Reverse Mortgages Vs. Annuities Comparison: Key Differences

Here’s a breakdown of the differences between reverse mortgages and annuities to see what sets them apart!

| Aspect | Reverse Mortgage | Annuity |

|---|---|---|

| Expected Returns | The money you receive isn't actually extra cash. It's your own money from your home's equity. Therefore, you won't earn any profit from it unless you live longer than expected. | Annuities come in various types, each with its own way of paying out, making it difficult to predict the return. It's important to check for any fees that could eat into your benefits. |

| Closing Costs & Fees | You might not notice the fees upfront because they're often taken from the money you borrow. | Annuities may have surrender fees if you withdraw funds early, as well as yearly fees to the company. |

| Tax Burden | When you get money from a reverse mortgage, it's not taxed because it's essentially a loan against your own equity. | Your earnings grow tax-deferred until you start taking withdrawals, which are then taxed as regular income. If you use a retirement account to fund an annuity, you might even get a tax deduction for your contribution. |

Types of Annuity

You have a variety of annuity options in the financial market today, but here are the ones that I think you should consider taking a look at.

-

Fixed Annuity

-

➙ A fixed annuity offers a guaranteed payment amount, providing stability and predictability for investors.

-

➙ With fixed annuities, the interest rates are set and guaranteed by the insurance company, ensuring a steady income stream for the annuitant. For those seeking a reliable and low-risk option, fixed annuities can be an attractive choice.

-

-

Variable Annuity

-

➙ Variable annuities offer payments that depend on the performance of underlying investments.

-

➙ However, with this potential for higher returns comes increased risk, as market downturns can lead to lower payouts. Additionally, variable annuities often come with higher fees, which can eat into investment returns over time.

-

-

Indexed Annuity

-

➙ Indexed annuities provide a combination of guaranteed interest rates and returns linked to the performance of an underlying index.

-

➙ This hybrid approach offers some protection against market losses while still allowing for potential growth based on market performance.

-

➙ However, it's essential to carefully consider the terms and features of indexed annuities, as they can vary widely among providers.

-

Beware of Reverse Mortgage Rip-Offs: 4 Expert Tips

When it comes to reverse mortgages and annuities, it's crucial to stay alert for potential scams. While these financial tools can be helpful, there are people who might try to trick you.

They target homeowners who may not know all the facts. To protect yourself, do thorough research, choose trusted lenders or insurance companies, and seek advice from a reliable loan officer before committing to anything. Here are a few tips to stay away from such rip-offs.

-

1. Stick with the Pros

When it comes to choosing lenders or insurance companies, go for the gold standard. Look for the best reverse mortgage lenders with a solid reputation for being upfront and honest. Avoid shady characters who might try to rush you into a deal you're not ready for.

-

2. Eye the Fine Print

Don't just skim through those contracts, give them a good read. Pay close attention to details like fees, interest rates, and payment terms. If something smells fishy or sounds too good to be true, don't hesitate to get a second opinion from a trusted financial advisor.

-

3. Watch Out for Sales Sharks

Don't let pushy sales tactics reel you in. If a salesperson starts cranking up the pressure, take a step back. Remember, it's your money and your future, so take your time and make a decision that's right for you.

-

4. Listen to Your Gut

Trust your instincts when it comes to financial decisions. If something feels off or too good to be true, it probably is. Don't ignore that little voice in your head!

Now's the Moment to Select Your Best Option

It’s decision time! When it comes to deciding between reverse mortgages and annuities, it's essential to consider your personal circumstances and financial goals.

Both options offer distinct advantages and considerations, so there's no one-size-fits-all solution. Each option has its perks and things to think about, so take your time to pick what fits your situation best. Just weigh your choices, ask for a loan officer’s advice first, and make a decision that puts you on the right track for the future.

About the writer

Connie Hedrick

Reverse Mortgage Expert

With more than ten years of dedicated service in the mortgage industry, Connie is your go-to professional for reverse mortgages, with a particular focus on supporting seniors in securing financial stability during retirement.