Missed mortgage payments can impact your homeownership, as they are one of the main signs leading to foreclosure. Mortgage reinstatement is often seen as one of the best ways to get back on track and secure your homeownership

However, not all requests get approved, whether you have a traditional mortgage or a package mortgage loan. Today, we'll discuss why some requests are denied and what you can do if this happens.

-

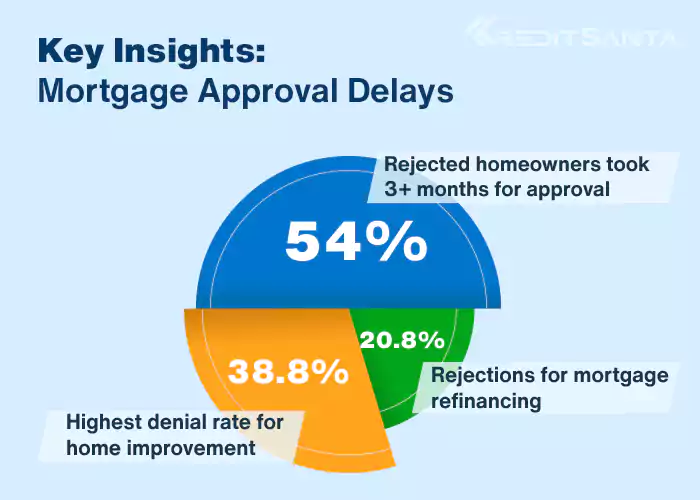

The rejection rate for mortgages was 13.2%.

-

The reinstatement quote that the servicer sends you will provide the precise amount you need to pay to get current on the debt and a good-through date for that amount.

-

A mortgage reinstatement letter is a document detailing the funds you need to reinstate your mortgage.

Key Takeaways :

Understanding Mortgage Reinstatement

During foreclosure proceedings, the Federal Law requires lenders to wait for 120 days before proceeding with the foreclosure process. This period presents a prime opportunity for homeowners to avoid foreclosure through mortgage reinstatement.

With a reinstatement, you can settle all missed payments along with late fees, restoring your defaulted mortgage to good standing.

Moreover, reinstatement benefits both you and your lenders. Wondering why? The reinstatement process is far more cost-effective than foreclosure.

💡Remember

Reinstatement can’t be done automatically by your lenders. You need to let them know that you require a mortgage reinstatement.

How Do You Get Started With the Reinstatement Process?

If you'd like to restart your mortgage journey and promise yourself that you won't miss any monthly payments, here's how you can get started 👇

-

Your primary step would be to get in touch with your lender or the company that manages your mortgage payments.

-

Ask them for a reinstatement request, and they'll give you a letter explaining how much money you need to pay & when to get your loan back paid in full.

-

Usually, the mortgage reinstatement period differs in each state. For Eg- in California, you can ask to reinstate your mortgage for up to 5 days. In Texas, you have 20 days from when the foreclosure process begins to reinstate your mortgage.

-

Once you make this payment successfully, your loan will be restored to its original terms, and you'll resume making regular payments.

Can A Mortgage Company Deny Reinstatement?

Yes, a mortgage company can deny your request for reinstatement if you don't pay all the owed money according to the quote provided. For a successful approval, make sure to reinstate your mortgage, you need to pay all the money owed according to the quote provided. This includes:

-

-

➙ Missed payments and current payments that you owe.

-

➙ Late fees, if you have any.

-

➙ Costs for inspecting the property, if needed.

-

➙ If a sheriff's sale notice was canceled, you might need to pay a recording fee.

-

If you follow the quote and are prepared to repay everything you owe, your reinstatement request will be approved.

Alternatives to Explore if Reinstatement is Denied

You might have faced a denial if there was a mistake in your quote or if you didn’t have enough money to repay in full. Regardless of the reason, you can still explore other options.assess your financial standing.

-

Forbearance

Your lender lets you pause or lower your monthly mortgage payments for a short time to help you through financial difficulties.

-

Refinancing

You replace your current mortgage with a new one that has better terms, like a lower interest rate, to reduce your monthly payments.

-

Loan modification

Lenders change some of your loan terms, like the length or interest rate, to make your monthly payments more manageable.

-

Bankruptcy

This is a legal process where you either stop foreclosure or clear your debts, but it can hurt your credit score. It's a last resort and should be done only after talking to a bankruptcy lawyer.

Is It Possible To Negotiate Mortgage Reinstatement Terms?

A mortgage reinstatement can help you keep your home if you’re ready and have enough funds to repay your loan, but you can't negotiate the terms with your lender.

If you still can't afford to reinstate the mortgage, don't worry. You have other alternatives like the ones mentioned above.

Total Mortgage Reinstatement Costs

The entire cost depends on various fees that you’re required to pay throughout the reinstatement process. It includes:

-

-

➙ The missed payments and any upcoming payments you owe, including the loan amount and interest.

-

➙ Late fees for missing payments.

-

➙ Anycosts for inspecting your property, if needed.

-

➙ Fees for the lawyers or trustee handling the foreclosure.

-

➙ Other expenses the lender had to pay to protect their property.

-

➙ Rarely, a fee for recording a notice to cancel the foreclosure sale..

-

Endnote: Focus on Protecting Your Property

Mortgage reinstatement can be a smart move to get your mortgage back on track, but it's not the only option available. If your request is approved, that's fantastic!

However, if you face denial, don't be discouraged. There are other options available, and you can always talk to your lender to find a solution that fits your unique financial situation.

Remember, when one door closes, another one opens! Keep pushing forward, and you'll eventually find your way back to safeguarding your property and its equity.

About the writer

Stephanie Trudeau

Reverse Mortgage Expert

Stephanie is here to make your loan process smooth sailing. With three years of experience working alongside Jeremiah, she's dedicated to ensuring your paperwork is handled efficiently.