Limited funds? and Minimal savings? Considering FHA loans could be a wise move! Backed by the HUD, it’s an ideal opportunity for those with lower credit scores to achieve homeownership.

But, wait. What if the house you're eyeing down the street is owned by a bank? Can you still use an FHA loan to make it yours? Stay tuned – I'll reveal the answer with just a scroll! Plus, I'll outline the key guidelines and considerations for you.

-

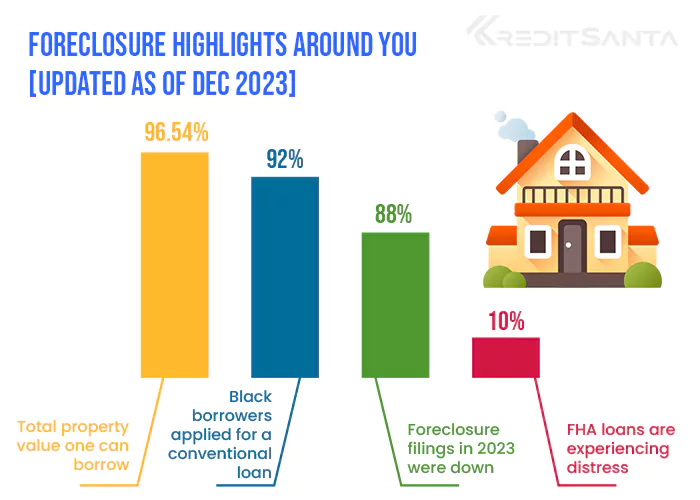

If your credit score is 580 or higher, you can get an FHA loan for up to 96.5% of a home's value.

-

The FHA doesn't give out mortgage money directly. Instead, a bank or lender approved by the FHA provides the loan.

-

FHA loans are only for primary residences, not for buying homes as investments.

-

Federal Housing Administration (FHA) loans had the highest delinquency rate in the United States in 2023.

Things To Remember :

Understanding FHA Loans

This loan option is mostly chosen by first-time homebuyers who have limited funds and can't afford hefty down payments.

Here's why it's worth considering:

-

They offer flexible terms and lenient credit standards.

-

Secondly, you can use an FHA loan to purchase a foreclosed home , but there are considerations to factor in.

-

They’re assumable mortgages, meaning that if you decide to sell your home, the buyer can take over your existing FHA loan.

Now, let’s understand a bit more about purchasing a foreclosed home with an FHA loan by looking at both the upsides and pitfalls to ensure that your decision aligns with your goals and priorities.

Buying Foreclosed Homes with FHA Loan: Pros & Cons

If you're all about making smart choices, then it's key to check out both the upsides and the downsides. That way, you're fully in the know and can pick what works best for you.

| ✅Pros | Cons❌ |

|---|---|

| Foreclosed homes often come at a discount compared to new ones. With an FHA loan, you can grab one of these deals and benefit from low interest rates. | Approval for an FHA loan might be difficult if the house needs repairs to meet FHA property standards. |

| FHA loans are great for folks who may not meet the credit standards of traditional mortgages. | Foreclosed homes are often sold at lower prices, attracting many buyers looking to renovate and resell. |

| FHA loans offer easy refinancing options, letting borrowers adjust loan terms without higher costs. | Foreclosed homes are sold "as-is," meaning you're responsible for any repairs after purchase. |

Guidelines To Follow Before Making A Purchase

Got your sights set on securing that approval? Well, if that's the case, here's a rundown of the requirements to ensure you're on track for a solid thumbs-up.

-

-

➙ The foreclosed home you’re looking to buy must be your primary residence upon occupancy.

-

➙ Your property's value must be assessed by an FHA-approved appraiser.

-

➙ The property must meet safety and habitability standards set by HUD.

-

➙ Your FICO score must be more than 500 .

-

➙ Keep your debt-to-income ratio (DTI) below 57%.

-

➙ Make a down payment of 3.5% or more.

-

➙ Pay upfront and monthly mortgage insurance premiums (MIP).

-

With every requirement met, your path through the application process will be smooth sailing, free from any detours or roadblocks.

Time for a tidbit!

A pre-approval not

only gives you insight into your budget but also helps you focus

your home search on properties that are within your financial reach.

3 Tips To Get Your FHA Loan Pre-Approved

That’s especially true in a competitive market! Having a preapproval letter shows sellers that you're a serious buyer and also gives you the power to negotiate with the sellers knowing that you're financially qualified to purchase their property.

-

Shop Around For FHA-Approved Lender

Most banks, credit unions, and online lenders offer FHA loans. Contact several lenders to get quotes because their terms can differ altogether.

-

Get Your Documents In Place

Lenders will ask for financial information to assess your ability to pay back the loan. This might include recent pay stubs, W-2 forms, bank statements, and other documents showing stable income. Make sure you have them all before starting your application.

-

Assess Loan Offers

After applying, lenders will provide a loan estimate showing your monthly payments, interest rate, and closing costs. Compare these estimates from different lenders before making a decision.

Challenges and Considerations

While FHA loans offer undeniable perks, they're not without their challenges, especially when it comes to purchasing foreclosed homes. Here are a few factors to consider, so you don’t face surprises in the middle of your application process.

-

Property Condition

Foreclosed homes are often sold in distressed conditions, requiring extensive repairs. While FHA 203(k) loans can cover renovation costs, navigating the appraisal process for homes in poor condition can be tricky.

-

Mortgage Insurance Premiums (MIP)

Unlike conventional loans, FHA loans require both upfront and annual mortgage insurance premiums. These additional costs can add up over time, impacting your overall housing expenses.

-

Stringent Appraisal Requirements

The best FHA loans strict appraisal guidelines, with appraisers assessing the property's condition and safety standards in & out. If the home doesn't meet FHA requirements, you may need to address deficiencies before securing financing.

Alright here’s the deal – If you're ready to tackle these challenges upfront, they might not even feel like challenges at all. By taking the right steps early on, you'll breeze through the process like a pro!

Putting It All Together

Thinking about using an FHA loan to buy a foreclosed home? It's a great option if you're tight on savings. FHA loans offer flexible credit requirements, low down payments, and funds for renovations.

But, before diving in, remember to be cautious. Get comfortable with things like mortgage insurance premiums and meeting the minimum down payment. It'll make the process much smoother.

About the writer

Stephanie Trudeau

Reverse Mortgage

Expert

Stephanie is here to make your loan process smooth sailing. With three years of experience working alongside Jeremiah, she's dedicated to ensuring your paperwork is handled efficiently.